Canada’s economy faces a “sink-or-swim” decade, according to the first study to assess Canada’s economic prospects in the face of accelerating global market shifts responding to climate change.

Sink or Swim: Transforming Canada’s economy for a global low-carbon future is a new report from the Canadian Institute for Climate Choices, Canada’s independent climate policy research institute. The report assesses Canada’s economic prospects in response to the global low-carbon transition and offers recommendations for successfully navigating that transition.

Countries responsible for over 70 per cent of global GDP and over 70 per cent of global oil demand have committed to reaching net zero emissions by mid-century. Trillions of dollars in global investment will move away from high-carbon sectors. The impact of these global shifts will be profound, shifting trade patterns, reshaping demand, and upending businesses that are too slow to adapt.

Source: Analysis by the Canadian Institute for Climate Choices (2021) based on data from Statistics Canada (2016a). This figure shows the share of the workforce directly employed in transition-vulnerable sectors by province and territory. The size of each square represents the share of workers in transition-vulnerable sectors relative to each province and territory’s total workforce. The size of polygons within each square illustrates the share of workers within individual sectors. Emissions-intensive manufacturing includes NAICS codes 324, 325, 326, 327 and 331.

To better understand the risks and opportunities of this transition for Canada, Sink or Swim stress tests publicly traded companies under different scenarios. Without major investment, the report finds, many exporters and multinationals will see significant profit loss in the coming decades. The stakes are high for Canada, with almost 70 per cent of goods exports and over 800,000 jobs in transition-vulnerable sectors, including oil and gas, mining, heavy industry, and auto manufacturing.

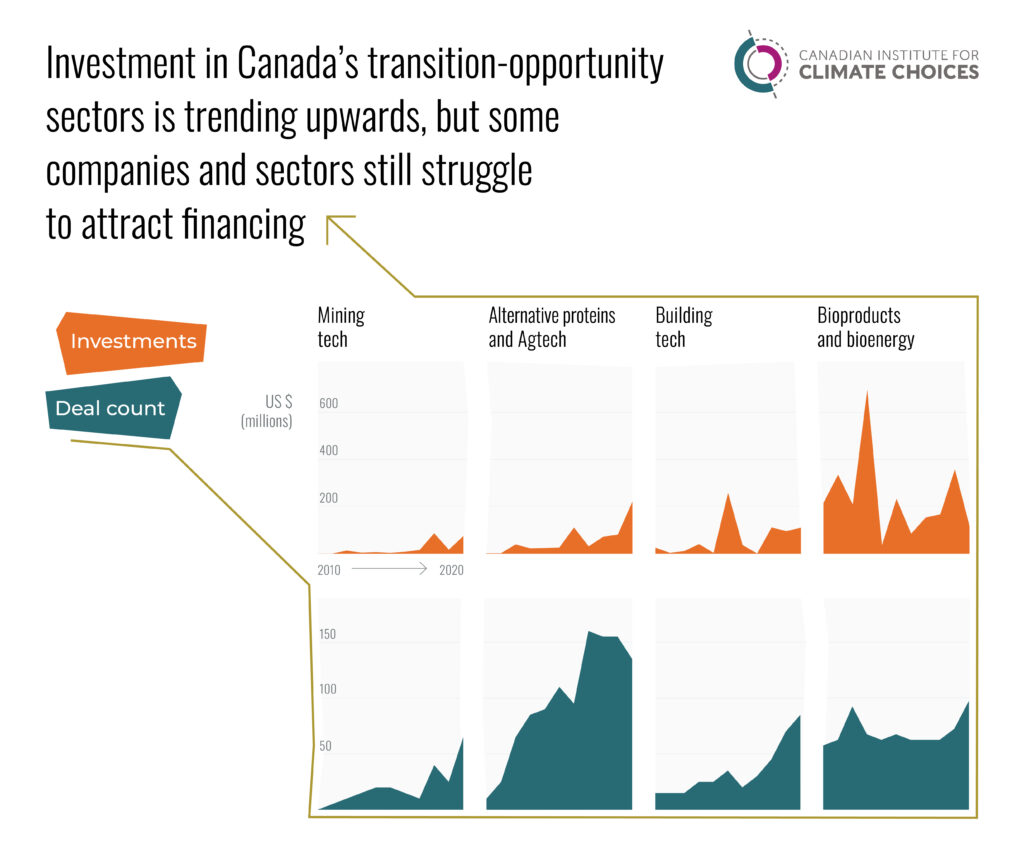

Source: Analysis by the Canadian Institute for Climate Choices using data from PitchBook (2021). Notes: This figure shows the total capital invested across nine transition-opportunity sectors in US dollars and the number of completed business deals (i.e., investment transactions). Values include private equity, venture capital, corporate and strategic mergers and acquisitions, initial public offerings (IPOs) and liquidity, and debt. The analysis captures businesses that are primarily focused on the relevant technologies, products, and services in each sector. More detailed analysis on each opportunity is available at https://climatechoices.ca/reports/sink-or-swim. Data is drawn from a custom search and has not been reviewed by PitchBook Analysts.

“Our analysis shows that global policy and market changes will have a profound impact on Canada’s economy and workforce,” said Rachel Samson, clean growth research director at Climate Choices. “To stay competitive, Canada needs to rapidly scale up new, transition-consistent sources of growth—and successfully transform existing ones. Moving too slowly is now a greater competitive risk than moving too quickly.”

To succeed in this global transition, the report concludes, Canada must use climate policy, company disclosure, and targeted public investment to mobilize private finance and improve the resilience of Canada’s workforce and impacted communities.

For further information, click here: Full Report