By Jeff Horlor

Struggling to assess your progress in improving your climate resilience? There are three broad steps to help an organization get started on its climate metrics journey. This article highlights what climate metrics your organization should be measuring and why.

In the market today, climate metrics, and targets based on these metrics, are the most underutilized and underreported pillar of the Task Force on Climate-related Financial Disclosures (TCFD). In fact, a survey the TCFD ran in 2019 found that 75 per cent of supporters found implementing these recommendations somewhat or very difficult. Both non-financial and financial companies have done well to incorporate climate change into their governance structures and oversight, strategic planning, and risk management processes.

However, issues remain around connecting the measuring and disclosing of climate risks and opportunities to meeting strategic climate change objectives. As a result, financial institutions and other stakeholders struggle to properly assess a business’s progress in improving its climate resilience. This is where climate metrics and targets can play a critical role for all businesses, as outlined in the TCFD’s most recent proposed guidance on the topic.

To help you get started on your climate metrics journey, here’s a summary of what your business can do in three broad steps:

- Assess your climate risks and opportunities

At Manifest Climate, we are big proponents of not “putting the cart before the horse.” Before any business embarks on using climate metrics, the first step should be to gain a better understanding of the unique climate-related risks and opportunities that your business faces. Climate metrics can then be used to measure and monitor these risks and opportunities. Conveniently, the TCFD has provided us with a useful lexicon of climate-related risks and opportunities, outlining the transition (policy, market, technology, and reputation) and physical (chronic and acute) risks that can impact a company’s long-term sustainability and financial performance. These risks and opportunities can be broken down further and put into the context of the business being assessed.

- Define high-level strategy and ambitions

Once you have a better understanding of the climate risks and opportunities facing your business, strategic discussions need to take place on how your business can, and should, respond. To build climate resilience, some organizations may have to take a risk-centric approach, while others may need to reconsider their entire business models. For example, a renewable energy company’s business model may already be well-positioned to be part of the solution to mitigating global emissions, but key assets may be exposed to increasingly extreme weather events, so a risk-centric approach may be more appropriate. Alternatively, an oil and gas company may have to change its overall business strategy in order to reduce its exposure to transition risks.

A common theme today for businesses is the goal to reduce their GHG emissions and achieve net-zero by 2050 (or earlier). Businesses are seeing this as a key aspect of their strategic response to climate change, which can both reduce their exposure to transition risks and — by mitigating emissions — help reduce the physical impacts of climate change on their operations, the wider economy, and society.

- Identify relevant climate metrics

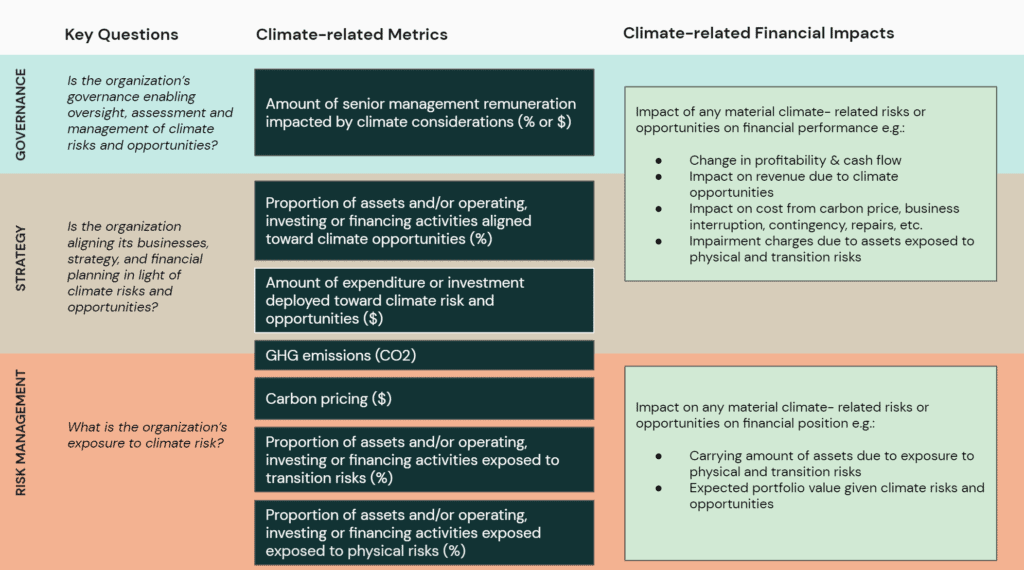

Once a business has a better idea of the risks and opportunities they face, and what their high-level strategic response will be, the TCFD’s proposed guidance has provided a useful baseline of seven climate-related metrics businesses can look to.

Figure 1 Reference:

Proposed Guidance on Climate-related Metrics, Targets, and Transition Plans, TCFD

The TCFD stresses how a “box” should not be put around the metrics and targets pillar of the framework. Metrics are meant to be used to enhance and monitor a business’s governance, progress against strategic objectives, and management of climate risks and opportunities. While the TCFD is proposing all businesses report across the seven metrics shown in the image – Figure 1, the Framework is not entirely prescriptive. Businesses need to contextualize these proposed metrics based on the risks and opportunities identified, and their overall climate strategy and ambition.

In addition to the seven metrics supplied, two other climate-related risk indicators are proposed (see right side of the image – Figure 1): the impact of any material climate-related risks or opportunities on financial performance, and the impact of any material climate-related risks or opportunities on financial position.

Strategic Metrics

To enhance and monitor their climate strategy and associated financial planning, businesses should begin to measure how they are aligning their activities (assets, operating activities, or, for financial institutions, their investing and financing activities) with the climate opportunities — both mitigation and adaptation — they’ve identified. For example, for an electric utility company, this may be the percentage of their energy generation assets that are renewable and the proportion of company revenues associated with these assets. Another example may be a mining company that measures the percentage of mining assets tied to those metals and minerals set to see higher demand due to the adoption of lower-carbon technologies.

Businesses are also urged to measure how their financial planning (e.g., capital expenditures (capex) or investment) is aligned with climate opportunities. Using the same examples from above, this may be the amount of capex a utility has pegged to go towards renewable energy assets or a mining company’s plans to invest in new mines.

Risk Metrics

On the risk management side, businesses can use a price on carbon emissions to assess the potential financial impacts resulting from the introduction and/or increase of carbon taxes or cap-and-trade schemes, or as a proxy for other regulatory mechanisms aimed at improving the economics of low-carbon activities. Additionally, to support the measurement of climate risk exposures, businesses should focus on measuring the proportion of their business activities (assets, operating activities, or, for financial institutions, their investing and financing activities) that are exposed to physical and transition risks. These metrics can help show how exposure to these risks is changing overtime periods as a result of the business’s climate strategy. For example, a Real Estate Investment Trust (REIT) may look to measure the existing exposure of its real estate assets to flood and/or wildfire risk, as well as the proportion of those assets that would require retrofitting if governments were to introduce regulation on the use of natural gas.

To enhance the forward-looking nature of the above risk management metrics, climate scenarios can be used to improve the assessment of transition and physical risks across different time horizons, feeding this information back into the strategic planning process.

GHG Emissions

The one metric that does not require much contextualization is GHG emissions, both absolute and intensity-based, as these have emerged as table stakes across financial and non-financial sectors. Businesses are asked to disclose their Scope 1, 2, and 3 (which includes those stemming from the financial portfolios of investors, banks, and insurance companies) emissions. For businesses, GHG emissions can represent a metric used in both defining strategic objectives (e.g., meeting an operational or financial portfolio emissions reduction target) as well as managing risk (e.g., understanding transition risk exposures, such as regulations aimed at reducing emissions).

Governance Metrics

To improve a business’s governance of its climate strategy and risk management, climate-related metrics can be tied to senior management remuneration during their tenure rather than longer time-horizons associated with future leadership. Like other metrics and KPIs used by businesses today, this can incentivize continued action and leadership for building climate resilience.

Jeff Horlor is a climate strategist with Manifest Climate. He helps financial institutions become climate resilient by integrating climate-related risks and opportunities into their business operations, investment strategies and risk management, as well as assisting with TCFD-aligned disclosures.

Jeff Horlor is a featured panelist in Manifest Climate’s upcoming webinar, TCFD 103: How to get climate metrics and targets right, on October 19 at 2 PM EDT. To register, click here.