As You Sow and Corporate Knights today released their ninth update of the Carbon Clean200, a list of 200 publicly traded companies that are leading the way among their peers to a clean energy future.

As You Sow is a non-profit foundation based in Berkeley, California, that was chartered to promote corporate social responsibility through shareholder advocacy, coalition building, and legal strategies. Corporate Knights is a media, research and financial information products company based in Toronto, Ontario focused on promoting an economic system where prices fully incorporate social, economic and ecological costs and benefits, and market participants are clearly aware of the consequences of their actions.

This year, the Clean200 features Apple, Alphabet and Intel at the top of the list. On average, 58 per cent of revenues earned by Clean200 companies are classified as clean, which is up from 39 per cent in 2021 and significantly above the 20 per cent average clean revenue for their MSCI ACWI peers.

Clean200 2022 Update: Investing in a Clean Energy Future by Toby Heaps, Michael Yow, Matthew Malinsky, Andrew Behar is licensed under a Creative Commons Attribution 4.0 International License.

According to the authors, the featured companies are leading the way by putting sustainability at the heart of their products, services, business models, and investments, helping to move the world onto a more sustainable trajectory.

Key findings of the report:

- Geographically – Europe and the Americas each account for 37.5 per cent of this year’s Clean200, while the remaining 50 companies are headquartered in the Asia Pacific region. The United States dominated the 2022 list, with 52 companies on the Clean200, while Canada had the second largest share with 18, closely followed by China, which 16 Clean200 companies are headquartered in.

- Revenues – On average, 58 per cent of revenues earned by Clean200 companies are classified as clean, which is up from 39 per cent in 2021 and significantly above the 20 per cent average clean revenue for their MSCI ACWI peers.

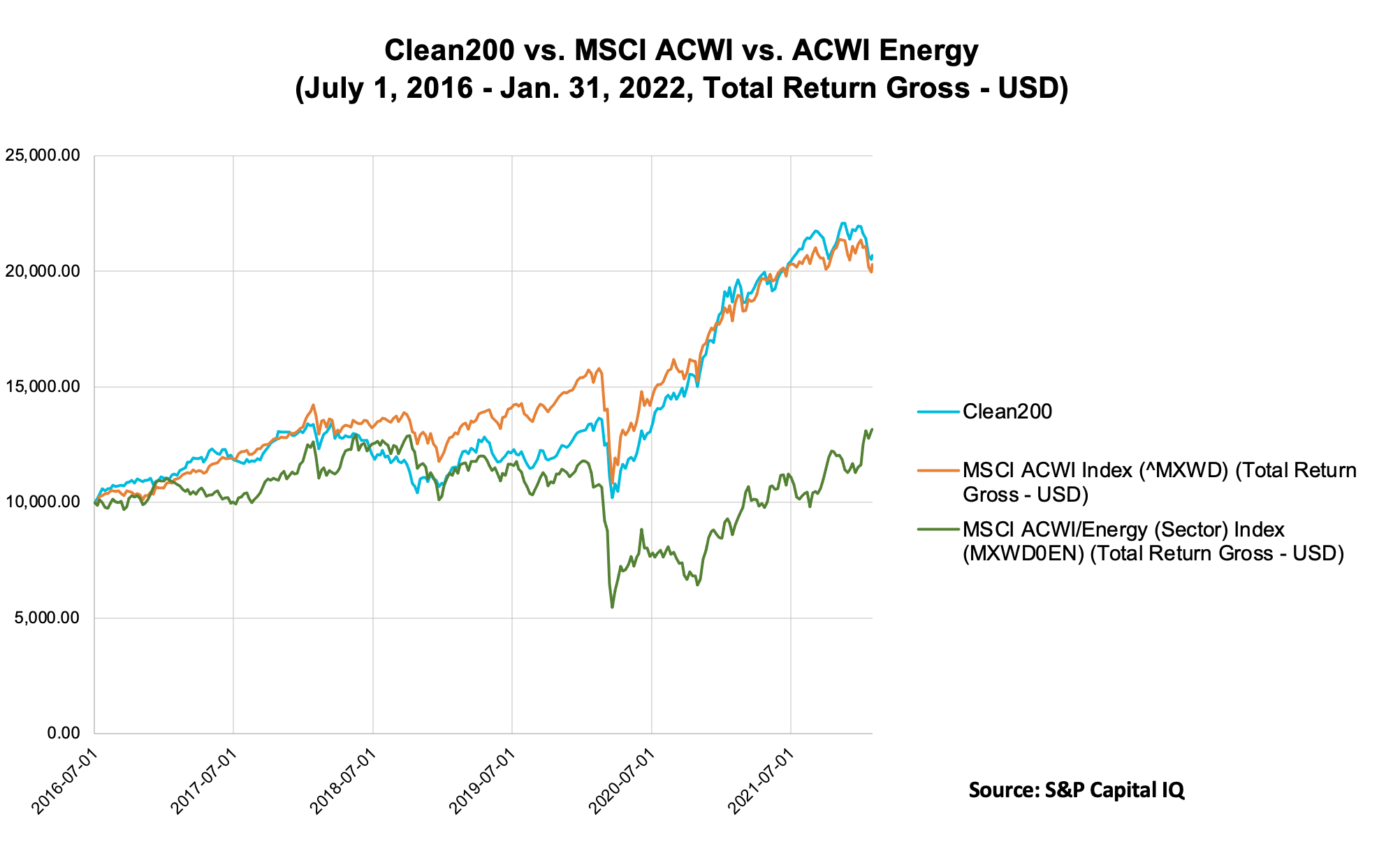

- Performance – As of January 31, 2022, the Clean200 has outperformed its MSCI ACWI peers by 3.94 per cent since the Clean200 was launched in July of 2016. Clean200 companies generated a total return of 107.09 per cent, beating the MSCI ACWI broad market index (103.15 per cent) and MSCI ACWI/Energy Index of fossil fuel companies (31.67 per cent) on Total Return Gross — USD Basis from the Clean200 inception of July 1, 2016, to January 31, 2022.

To put the findings into context, the authors have pointed out that $10,000 invested in the Clean200 on July 1, 2016, would have grown to $20,709 by January 31, 2022, versus $20,315 for the MSCI ACWI broad market benchmark and $13,167 for the MSCI ACWI/Energy benchmark for fossil fuel companies.

These are the Canadian companies that made the cut:

| Rank | Name | Country | GICS Sector |

|---|---|---|---|

| 78 | Canadian National Railway Co | Canada | Industrials |

| 96 | Celestica Inc | Canada | Information Technology |

| 102 | Telus Corp | Canada | Communication Services |

| 106 | Cascades Inc | Canada | Materials |

| 111 | WSP Global Inc | Canada | Industrials |

| 114 | Canadian Solar Inc | Canada | Information Technology |

| 117 | Canadian Pacific Railway Ltd | Canada | Industrials |

| 145 | Stantec Inc | Canada | Industrials |

| 154 | Transcontinental Inc | Canada | Materials |

| 157 | Northland Power Inc | Canada | Utilities |

| 174 | GFL Environmental Inc | Canada | Industrials |

| 176 | KP Tissue Inc | Canada | Consumer Staples |

| 177 | Gildan Activewear Inc | Canada | Consumer Discretionary |

| 182 | Boralex Inc | Canada | Utilities |

| 183 | Innergex Renewable Energy Inc | Canada | Utilities |

| 194 | TransAlta Renewables Inc | Canada | Utilities |

| 195 | Cogeco Communications Inc | Canada | Communication Services |

| 198 | Ballard Power Systems Inc | Canada | Industrials |

Looking forward, the authors point to how BlackRock, the largest investor in the world, with a massive US$8.7 trillion under management, has jumped on the net-zero-emissions bandwagon. “It is only a matter of time before it becomes the standard, placing a 100% sustainable and zero-carbon economy within our grasp. To date, financial firms have pledged that more than US$130 trillion of assets will be net-zero by 2050.”