Wednesday, September 17, 2025

General Market Commentary

The Bank of Canada reduced its target for the overnight rate by 25 basis points on September 17, 2025 to 2.5%, with the Bank Rate at 2.75% and the deposit rate at 2.45%. According to the Bank, after remaining resilient to sharply higher U.S. tariffs and ongoing uncertainty, global economic growth is showing signs of slowing.

When it comes to environment and energy related investments, Prime Minister Mark Carney has announced the launch of the new Major Projects Office (MPO). The MPO will work to fast-track nation-building projects by streamlining assessment and approvals and helping to structure financing, in partnership with provinces, territories, Indigenous Peoples, and private investors.

“At this pivotal moment, we promised Canadians we would deliver results—building Canada into an energy superpower and the strongest economy in the G7,” said Tim Hodson, Minister of Energy and Natural Resources, who said the announcement of the MPO is “a leap forward in achieving those results in a responsible strategic way so we can transform how we build in this country for today and into the future.”

Hot Sector News

The Canadian Renewable Energy Association (CanREA) and Dunsky Energy + Climate Advisors, launched the first Canada-specific report on the market outlook for renewable energy projects in Canada on September 16, 2025.

Canada currently ranks 9th globally for installed wind energy capacity, 20th for installed battery energy storage capacity, and 24th for installed solar energy capacity. According to the report, surging electricity demand, increasing cost competitiveness and enabling policy frameworks are now positioning Canada’s wind, solar and storage markets for rapid expansion.

“We designed this new market outlook report to offer uniquely Canadian market intelligence to support informed decisions by electricity sector stakeholders, renewable energy and energy storage developers, investors and analysts,” said Vittoria Bellissimo, CanREA’s President and CEO.

The report, entitled “Canada’s Renewable Energy Market Outlook: Wind. Solar. Storage,” provides a comprehensive outlook for the wind, solar and storage markets in Canada, including the national profile as well as deep dives into five markets (British Columbia, Alberta, Ontario, Quebec and Atlantic Canada), focused on the following:

- State of the market: Latest updates on deployment, policy development and provincial procurements.

- Cost outlook: Price forecasts and analysis of the future costs for wind, solar and energy storage, including CAPEX, OPEX, LCOE and PPA pricing.

- Market outlook: Projected deployments of wind, solar and storage in Canada, including installed capacity (GW) and energy generation (TWh).

- Impacts: Assessment of the broader economic, environmental and social impacts associated with the projected deployment.

Leonard Kula, Vice President of Strategic Initiatives at CanREA shared an overview on projected deployments, which represent significant reductions in the greenhouse gas (GHG) emissions associated with electricity production, thereby reducing the emission intensity of Canada’s grid by more than 90 per cent by 2050.

“It is going to happen, because solar energy and wind energy are the most affordable and quickly deployable technologies available anywhere in the world today, and grid operators increasingly recognize the value that energy storage can deliver in an evolving grid,” said Kula. “Every province and territory is currently deciding how to meet their growing electricity needs, and renewable energy and energy storage are important parts of the solution. The deployment of new wind, solar and energy storage provides a smart and reliable solution for the fundamental challenge that affects electricity markets across Canada.”

He also specified progress–and lack thereof–in various regions, starting with a discussion of the significant “turmoil in Alberta” as legislative, regulatory and market design changes are ongoing. “These changes have created significant uncertainty and threatened both higher costs and reduced revenues for renewable projects.”

Kula explained how Ontario, meanwhile, is on the edge of significant change after about a decade of flat demand, and that the Ontario system operator has launched a long-term procurement and expanded new capacity measures. “This will be followed by further procurement windows annually to acquire substantial amounts of energy and capacity producing resources in Ontario.”

He added that Hydro Quebec has announced four wind development zones that will be developed with First Nations and local communities and has committed to purchase 3,000 megawatts of solar power by 2035. There are several renewable project activities underway in Atlantic Canada as well.

Forecasted deployment and financial benefits

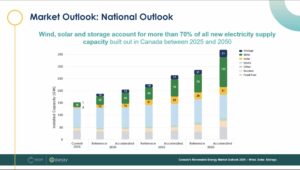

The report presents a market outlook for the deployment of wind, solar and storage in each focus market, based on modelling of cost-optimal portfolios calibrated to current policies, system needs and regional constraints. Where possible, according to the authors, the modelling aligns with the latest utility or system operator plans, adjusted for recent market or policy changes. Two scenarios (Reference and Accelerated) capture uncertainty in load growth, technology costs and resource development.

While they use industry-standard production cost and capacity expansion tools to ensure affordable, reliable system outlooks, the modelling does not include every possible resource or replicate the detailed reliability assessments conducted by utilities and system operators. Although this outlook focuses on wind, solar and storage, the framework allows other generation types (e.g., gas, hydro, nuclear) to be selected where cost-effective or policy-driven.

“The Outlook identifies a significant opportunity for renewable energy and energy storage deployment across Canada, with wind, solar and storage expected to account for more than 70 percent of all new electricity supply capacity deployed between 2025 and 2050,” said Ahmed Hanafy, Partner and Growth and Innovation Lead at Dunsky Energy + Climate Advisors, who emphasized that the report sheds light on the economic story of renewables.

“We’ve traditionally talked about the benefits that renewables bring in terms of an emissions production perspective, which is obviously still important, but there should be a lot more emphasis on the economic angle of renewables. We’re talking about something in the order of $14 to $20-billion of annual net investments in wind, solar and storage.”

The report points to a total investment opportunity of $143 to $205 billion for wind, solar and storage in Canada in the next 10 years. This investment level is expected to create approximately 250,000 to 350,000 direct and indirect full-time equivalent (FTE) job-years cumulatively in the same time period.

Between 2025 and 2035, the rapid growth in deployment of wind, solar and storage leads to a significant decline in the greenhouse gas (GHG) emissions intensity of electricity production in Canada, falling from more than 90 gCO2/kWh in 2025 to 27.4 gCO2/kWh in the Reference Scenario and only 16.1 gCO2/ kWh in the Accelerated Scenario. By 2050, the GHG intensity of the grid falls to 10gCO2/kWh or lower in our two scenarios.

To access the complete report, click here.

Stocks to Watch

Here is a list of Canadian cleantech stocks that we are monitoring for this column so far. We are open to suggestions from our advisors and readers.

| Name | Symbol | Price in $CDN August 15/25 | Price in $CDN September 15/25 | % Change |

| Algonquin Power & Utilities Corp. | AQN | $8.06 | $7.70 | -4.47% |

| Anaergia Inc. | ANRG | $1.38 | $2.86 | +107.25% |

| Ballard Power Systems Inc. | BLDP | $2.76 | $3.00 | +8.70% |

| *BIOREM Inc. | BRM | $2.05 | $2.07 | -0.98% |

| BluMetric Environmental Inc. | BLM | $1.35 | $1.35 | 0% |

| Boralex Inc. | BLX | $29.73 | $27.05 | -9.01% |

| *CHAR Technologies Limited | YES | $0.22 | $0.20 | -9.09% |

| Electrovaya Inc. | ELVA | $6.48 | $8.40 | +29.63% |

| Engine No 1 (Transform ETF) | NETZ | $104.54 | $106.89 | +2.25% |

| EverGen Infrastructure Corp. | EVGN | $0.40 | $0.47 | +17.50% |

| Greenlane Renewables Inc. | GRN | $0.14 | $0.24 | +71.43% |

| Li-Cycle Holdings Corp (Glencore PLC) | LICY | $11.04 | $11.04 | 0% |

| Loop Industries | LPEN | $2.14 | $1.90 | -11.21% |

| Northland Power Inc. | NPI | $21.94 | $22.96 | -4.65% |

| Tantalus Systems | GRID | $2.92 | $3.19 | -9.25% |

| *Thermal Energy International Inc. | TMG | $0.15 | $0.15 | 0% |

| Westport Fuel Systems Inc. | WPRT | $4.00 | $3.24 | -19.00% |

| Zinc8 Energy Solutions Inc. (Abound Energy) | ZAIR | $0.040 | $0.030 | -25.00% |

*The authors of this column own equity. It is not meant to be an endorsement, but simply a statement of this fact.

James Sbrolla is a veteran of the financial and environmental industries. To contact James, click here.

Connie Vitello is editor of Environment Journal. To contact Connie, click here.

To pitch an idea for an upcoming Market Watch column, or to suggest a stock, please contact us.

Featured image credit: Getty Images