Thursday, July 3, 2025

Governments and investors alike increasingly recognize that long-term financial returns depend on the viability of environmental and social systems. As a result, there has been a dramatic increase in sustainable finance policy reforms around the globe, intended to align financial flows with sustainability goals. Still, it’s safe to say that most investors and other financial actors are not yet playing their full role in addressing evolving sustainability challenges.

With that in mind, the Principles for Responsible Investment were developed by an international group of institutional investors reflecting the increasing relevance of environmental, social and corporate governance issues to investment practices. The process was convened by the United Nations Secretary-General.

The six Principles offer a menu of possible actions for incorporating ESG issues into investment practice:

- Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

- Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

- Principle 6: We will each report on our activities and progress towards implementing the Principles.

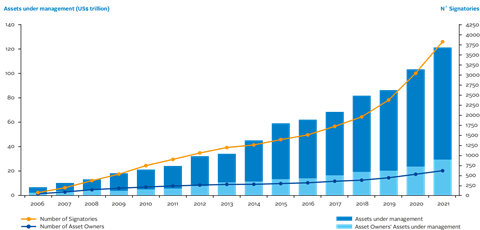

The PRI has grown consistently since it began in 2006. See the signatory directory to view a list of signatories. Graphic credit: UN PRI.

The Honourable Rosa Galvez is an environmental engineer, a former professor at Laval University, an independent Senator for the province of Quebec, and president of the ParlAmericas’ Parliamentary Network on Climate Change.

The Senator made a statement in reaction to the recently released report, Principles for Responsible Investment’s Legal Framework for Impact for Canada. According to Galvez, the report confirms the results of the consultation with dozens of national and international experts in sustainable finance which informed Bill S-243, the Climate-Aligned Finance Act (CAFA), which she introduced last year.

“Importantly, the report concludes that there is a ‘lack of legal clarity about investors duties and insufficient action by policy makers to encourage and enable responsible investment, rendering Canada a low-regulation jurisdiction by international standards.’ The report notes the absence of ‘consistent regulatory requirements for sustainability reporting that apply to all investors and issuers across Canada.’”

Senator Rosa Galvez. Credit: Independent Senators Group.

Galvez believes that Bill S-243, the Climate-Aligned Finance Act would bring much needed science-based consistency by aligning the activities of federal financial institutions and federally-regulated entities with Canada’s climate commitments. “The bill would guide Canada’s financial sector through an orderly transition to a low-carbon economy while safeguarding the financial system from the systemic risks posed by climate change and respecting other social and environmental sustainability goals.”

Galvez points out that the report also reminded us that Canada has the highest CO2 emissions per capita among G7 nations and recommends legislation to address climate-related risks. “It is time for Canada to go from laggard to leader on the climate and finance nexus. Allowing Bill S-243, the Climate-Aligned Finance Act, to proceed to a Senate committee review is the logical next step on that path.”